Under statistics, there were more than 300 million cryptocurrency owners worldwide in the summer of 2022. Moreover, the global crypto market capitalization was about $1.06 trillion in August of the same year. Furthermore, currently, nearly $112 billion is traded in cryptocurrency daily. And the popularity of crypto permanently grows. E.g., the BTC value has risen by over 540,000% from 2012 to 2022.

Thus, it’s quite profitable to trade cryptocurrency nowadays. However, experts recommend dealers apply specific online platforms (for example, https://cryptotracker.com/) to gain information about the actual crypto market situation. This may significantly increase traders’ incomes and reduce probable risks.

Key Cryptocurrency Features

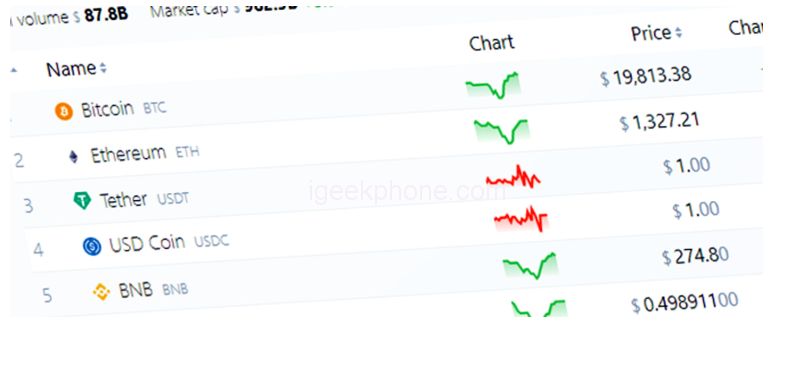

More than 6,000 various types of crypto are found over the world today. And each kind of this currency has its own peculiarities. As a result, this opens wide opportunities for dealers with different trading approaches.

Main Cryptocurrency Advantages

Such assets have the following pros compared to fiat money:

- High-reliability level. It’s impossible to counterfeit cryptocurrencies. This is due to the blockchain technologies at the heart of crypto transactions.

- Complete privacy. Traders only need to know the cryptocurrency wallet address to complete transactions. No personal owner information is required here.

- Absence of inflationary risks. The issue of digital coins is commonly limited. Thus, it’s impossible to ‘mint’ more than the established limit. And this reduces the risk of cryptocurrencies depreciation.

However, the main benefit of the described digital assets is their entire decentralization. That’s because cryptocurrencies aren’t tied to a certain jurisdiction and are dispersed around the world. Therefore, as with fiat funds, no external factors can affect this currency rate. So, only crypto market participants may influence the cryptocurrency rate.

Is It Really Safe to Invest in Crypto?

Some experts admit that cryptocurrency is perhaps the most secure way to hold assets in today’s geopolitical unrest. That’s because when such tensions had begun, crypto turned out to be the least susceptible to these changes.

Does Cryptocurrency Have Any Cons?

Some experts note a few disadvantages of the specified assets. The first flaw is its pretty high volatility. However, this factor greatly hinders mainly beginners in the crypto trading field. Thus, dealers need to gain a certain amount of experience to learn how to predict the cryptocurrency rate.

The second significant disadvantage is crypto transactions’ irreversibility. But here, everything isn’t so clear-cut too. Many experienced traders use intermediaries’ services. Thus, the payments are made only after the transactions’ approval by three parties, including mediators. Such an approach guarantees the return of coins in case of fraud detection.

How to Start Crypto Trading?

Initially, dealers need to understand what blockchain is and realize this technology’s key features. Next, the traders should:

- Create a crypto wallet. Among the popular are hardware, desktop, and mobile ones. The first wallet type is considered the most reliable.

- Select a crypto exchange and cryptocurrency for making deals. Here, it’s essential to choose only reputable platforms. Otherwise, traders risk losing their coins. The dealers may find lists of trustworthy crypto exchanges on thematic services (e.g., CryptoTracker.com).

- Pass the KYC procedure. It’s trader verification on a crypto exchange. Dealers should specify their personal data within this procedure.

Experts don’t recommend newbies invest all their savings in cryptocurrency. At the initial stage, keeping no more than 5-10% of available funds in coins is better. Also, skilled crypto traders advise the newbies to:

- look at the situation in the market in the long term when trading;

- systematically monitor cryptocurrency news and follow the global agenda;

- use trading robots (it simplifies the trading process).

Nay, beginners should regularly communicate with experienced crypto traders. This can be done, for example, on thematic forums and social network groups.