The last quarter of 2022 has not been easy for the smartphone industry. According to a report released by the research firm, mobile phone shipments fell by 17% in the three months from October to December 2022.

Global Smartphone Market

Apple remained at the top of the list, gaining the highest quarterly market share at 25%. In the fourth quarter of 2021, Apple’s share of global smartphone shipments was 23%. Samsung’s global mobile phone market share increased to 20% in the fourth quarter of 2022 from 19% in the fourth quarter of last year. Xiaomi ranks 3rd with an 11% global smartphone market share, compared with 13% last year.

Oppo captured 9% of the global smartphone market in the final quarter of last year, compared to 8% in the final quarter of 2021. Rounding out the top five is Vivo, which captured the same 8% of global smartphone shipments in Q4 2022 as it did in 2021. The “Other” category declined year-over-year from 28% in the fourth quarter of 2021 to the final quarter of 2022.

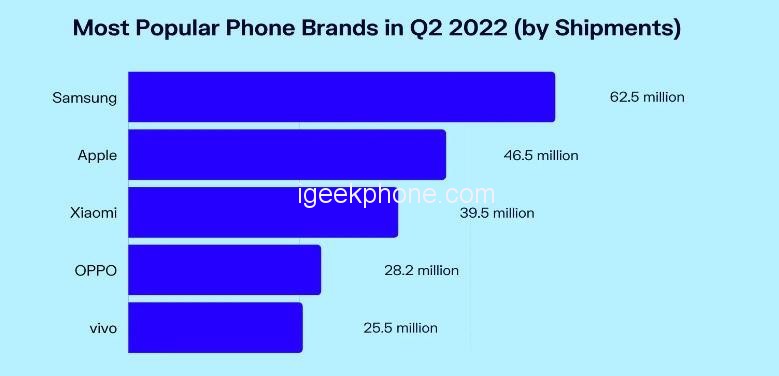

Throughout 2022, Samsung remains the number-one smartphone brand in terms of global shipments. Last year, the company accounted for 22% of global smartphone shipments. That’s higher than the 20% share it has in 2021. Apple is in second place, neck and neck with Samsung, and its share of the global mobile phone market will rise from 19% in 2021 to 21% in 2022.

Xiaomi had a 13% share of the global smartphone market last year, down slightly from 14% the year before. Oppo and Vivo will each account for 9% of global smartphone shipments in 2022. Oppo will have an 11% share in 2021, while Vivo will have a 10% smartphone market share for that year. Mixed brands in the “Other” category will account for 28% of global smartphone shipments by 2022, unchanged from 2021.

Some analysts said, “Smartphone suppliers are struggling in a difficult macroeconomic environment throughout 2022. The fourth quarter is the worst quarter in a decade. In 2023, the mobile phone market will be affected by rising interest rates and a weak economy. and inflation, although the low-end demand declined rapidly in the previous quarters, the high-end demand began to show weakness in the 4th quarter. The market performance in the fourth quarter of 2022 is in stark contrast to the demand surge and loosening in the 4th quarter of 2021 supply problem.”

“Suppliers will approach 2023 with caution, prioritizing profitability and protecting market share,” the analyst also said. “Suppliers are cutting costs to adapt to new market realities. Strong partnerships with channels are critical to protecting market share.” Important because tough market conditions for channel partners and suppliers can easily lead to tough negotiations.”

Analysts have also made predictions for the smartphone market in 2023. “While inflationary pressures will gradually ease, the impact of higher interest rates, a slowing economy, and an increasingly difficult labor market will limit market potential. This will affect saturated, mid-to-high-end markets such as Western Europe and North America.”

“Some regions are likely to grow in the second half of 2023, especially Southeast Asia, which is expected to see some economic recovery, while the recovery of tourism in China will help drive business activity,” the analyst concluded.

Chinese Smartphone market

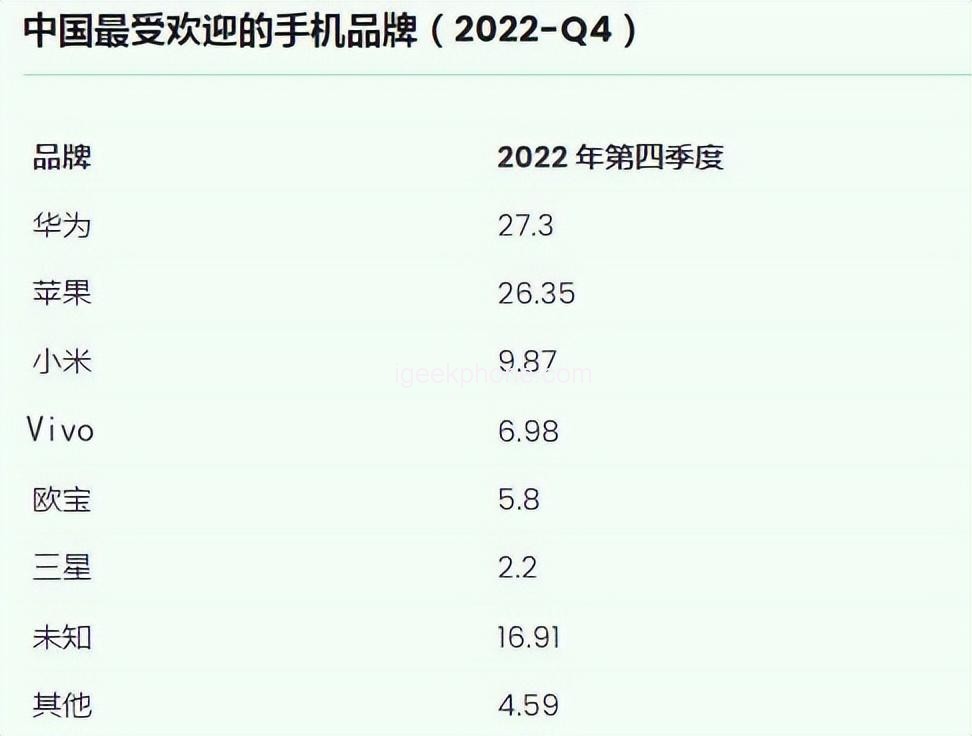

Huawei maintains its lead with an all-time high of 27.3% in the third quarter of 2022, followed by Apple at 26.35%, unknown brands at 16.91%, Xiaomi at 9.87%, vivo at 6.98%, and Oppo at 5.8%. Huawei also continues to rank first with an annual market share of 30.19%, followed by Apple at 23.42%, unknown brands at 15.79%, Xiaomi at 10.27%, vivo at 6.9%, and Oppo at 5.96%.

Market share of Huawei

Huawei is one of the leading mobile phone manufacturers in China, with a market share of 30.19% in 2022, 27.3% in the third quarter of 2022, and a current share of 28.32%. It also ranks first in total share in 2022.

Market share of Apple

Apple accounted for 26.35% market share in the third quarter of 2022, an increase from the previous quarter. Even if it is not a Chinese smartphone, Apple still ranks in the top two with the highest current market share (25.85%) and the annual share in 2022 (23.42%).

Xiaomi’s market share

With a current market share of 10.66%, Xiaomi ranks fourth among Chinese smartphone makers. It has been surpassed by brands such as Huawei and Apple, ranking first and second respectively. General market share mentions that Huawei leads with a current market share of 28.32%, followed by Apple with 25.85%, unknown brands with 16.52%, Xiaomi with 10.66%, vivo with 6.3%, and Oppo with 4.8%.

Vivo’s market share

Vivo ranked fifth in the third quarter of 2021 with a market share of 6.98%, followed by OPPO (5.8%) and Samsung (2.2%). It also ranks fifth in current market share for the month and 2022.

OPPO’s market share

In the third quarter of 2022, OPPO’s share of China’s smartphone market was 5.8%, a decrease of 0.03 percentage points from the fourth quarter of 2021, and a decrease of 0.64 percentage points from the first quarter of 2022. OPPO ranks sixth in both 2022 (full year) and 2022.

According to StatCounter, Honor has a market share of 0.46% in the third quarter of 2022, ranking 13th among other smartphone brands, followed by Sony and Meizu. But according to Counterpoint Research, Honor achieved a 20% share in the second quarter of 2022, making the brand the No. 1 among Chinese smartphone makers and the brand with the highest quarterly share.

Read Also: Moto G73 5G Released With Dimensity 930, Priced at €299.99

Do not forget to follow us on our Facebook group and page to keep you always aware of the latest advances, News, Updates, review, and giveaway on smartphones, tablets, gadgets, and more from the technology world of the future.

.jpg)