SeekingALPHA has published a comprehensive analysis of why tobacco giant Altria is buying independent e-cigarettes, what it means, and what the future holds. Here’s the full article.

introduce

Altria Group Inc (NYSE: MO) is in advanced talks to buy US e-cigarette maker NJOY Inc for US $2.75 billion, according to today’s sources, according to a Wall Street Journal article on Monday (Feb 27).

Altria shares are down about 10% over the past year. In the three years since we upgraded our rating to buy in February 2020, the stock has generated just 20% (including dividends) :

We believe the $2.75 billion acquisition of NJOY is the wrong decision for Altria.

While single-use e-cigarettes represent a fast-growing category, the precedent of other risk-reducing products suggests it is unlikely to catch up unless there is heavy-handed regulatory intervention. The rumoured price, at 18 times past sales, is too high in our view. Even if Altria management doesn’t see a future for its U.S. cigarette business, paying more dividends or buying JUUL might be a better use of capital. Altria shares remain cheap at 9.5 times earnings and an 8.1% dividend yield, and we maintain our buy rating for now.

For other tobacco stocks, Altria’s acquisition of NJOY has limited impact on British American Tobacco (BTI), but could be slightly negative for Philip Morris (PM) and Imperial Brands (OTCQX:IMBBY).

Who is NJOY?

NJOY Holdings is a privately held U.S. e-cigarette manufacturer that currently ranks third in the U.S. e-cigarette market.

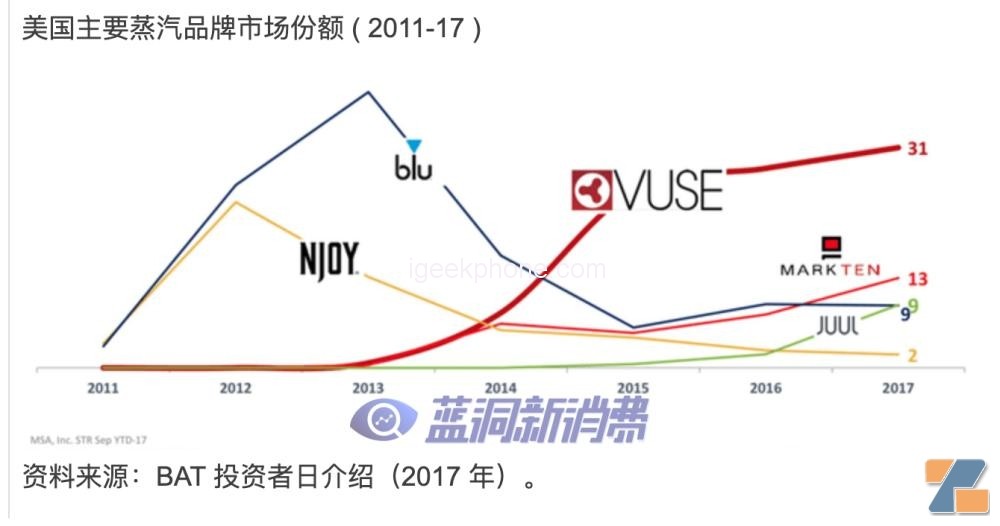

NJOY’s business initially ranked second in emerging markets in 2011-12 before collapsing due to a combination of poor product launches, regulatory fees and patent litigation, and it declared Chapter 11 bankruptcy in 2016:

NJOY emerged from bankruptcy protection in 2017 and has since been majority-owned by hedge fund Mudrick Capital.

NJOY has two main products, a disposable e-cigarette called NJOY Daily and a refillable e-cigarette called the NJOY Ace.

NJOY has about 3 percent of the U.S. vapor market by volume, according to Nielsen data, and analysts estimate NJOY’s sales at about $150 million through 2022. We think NJOY’s sales are primarily in the US.

NJOY is unusual in that both NJOY Daily and NJOY Ace have received the only FDA marketing authorization order (” MGO “) for their tobacco varieties to date.

British American Tobacco (here called “BAT”) only received MGO for its less popular Vuse products (Solo, Vibe, and Ciro), while Imperial Brands and Juul both received marketing denial orders for their products, Although the products were still on sale at the time the appeal is pending.

Japan Tobacco (OTCPK:JAPAY) also received MGO for some Logic products, but these were negligible.

Disposable e-cigarette category

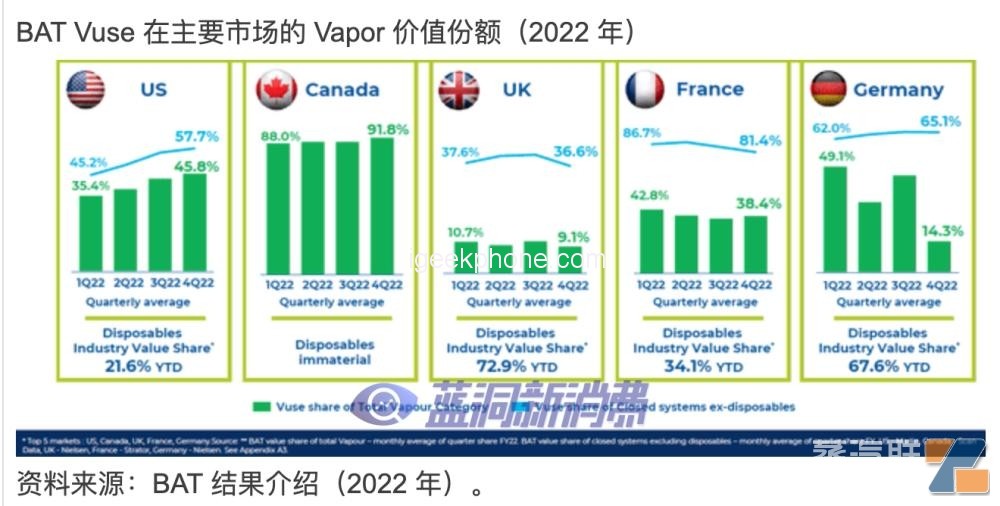

Single-use e-cigarettes represent a fast-growing category. Bat estimates that disposables will account for 21.6 percent of the steam market in the United States, 72.9 percent in the United Kingdom and 34.1 percent in France by 2022. (In Germany, Vapor accounts for just 1 percent of the nicotine market by retail value, and is tiny.)

BAT estimates that based on net sales of 949 million pounds ($1.1 billion) reported by BAT in 2022, single-use cigarettes generate about $600 million in revenue in the United States (net of excise taxes), while the steam category generates total revenue of $2.75 billion. That means NJOY’s 3% share of sales would only generate $800,000 to $85 million in revenue, assuming prices are in line with the market.)

Most other tobacco companies have recently launched their own single-use products, including BAT’s Vuse Go (May 2022), Philip Morris’s VEEBA (second quarter 2022) and Imperial Brands’ blu bar (November 2022). However, these products lack FDA authorisation and may not be available in the US for some time.

NJOY may keep her distance

We believe NJOY may not lead in the US market unless there is serious regulatory intervention.

NJOY’s share of U.S. Vapor sales is about 3 percent, according to Nielsen. Given the inherent limitations of Nielsen’s data, NJOY’s market share may actually be much higher.

As of Q4 2022, BAT’s Vuse had a value share of 45.8 percent, while Juul’s estimated value share was 26 percent.

The precedents of other risk-reducing products suggest NJOY is unlikely to catch up, even under Altria’s ownership.

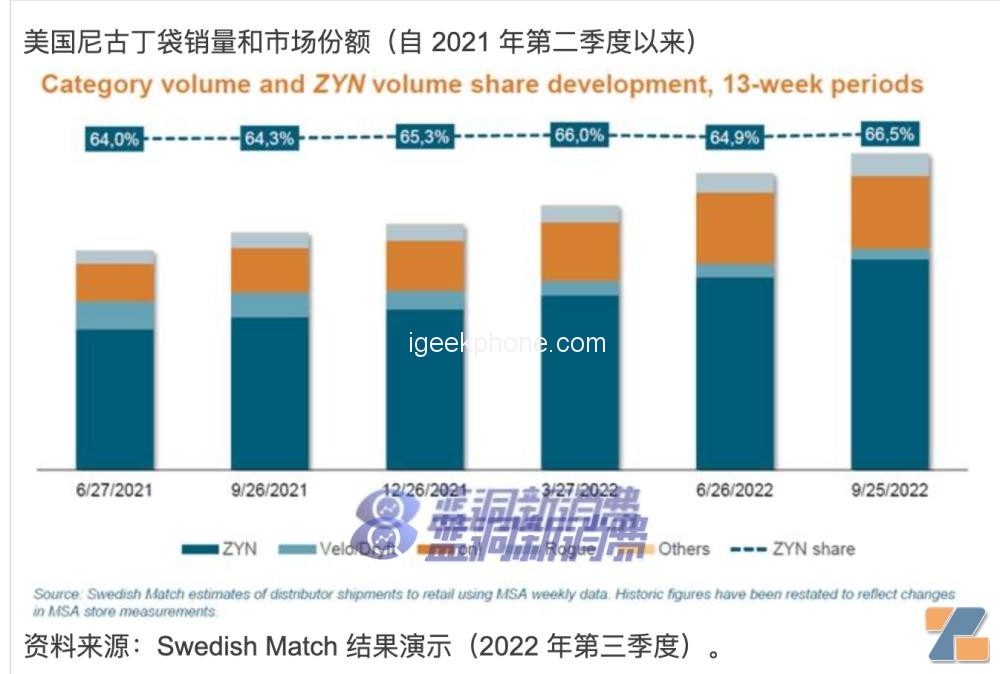

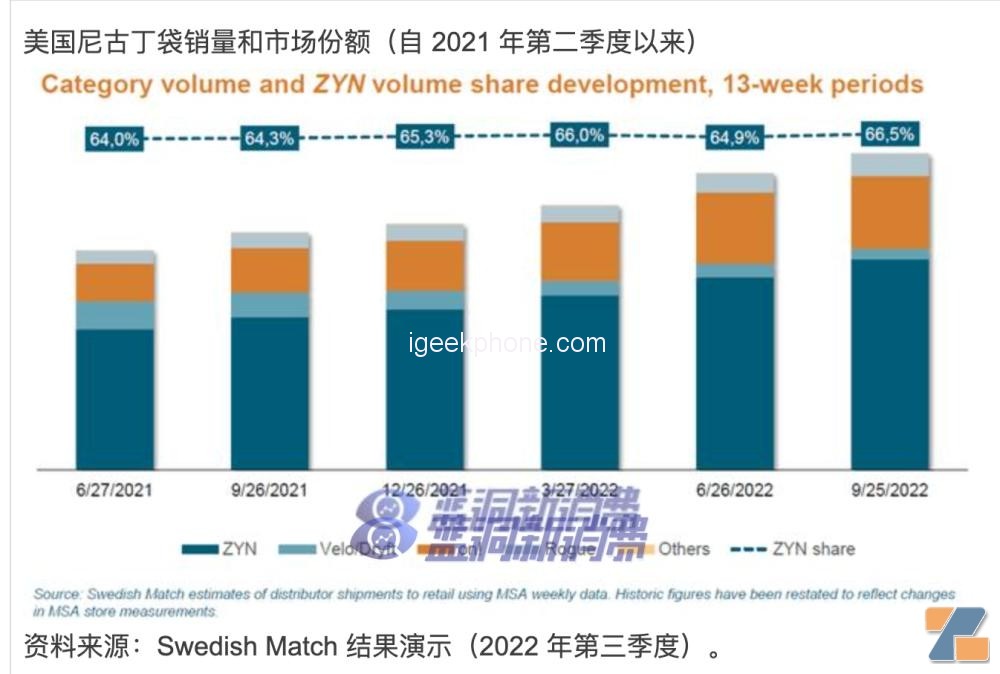

The US nicotine bag (currently 3% of the US nicotine market by value) is the best example, especially when incumbents make acquisitions there to compete with category leader Swedish MATch’s ZYN (OTC code: SWMAY). Altria paid $372 million for On! 80% of the shares. In 2019, BAT also acquired Dryft’s modern oral tobacco business in 2020. Despite these acquisitions, and the aggressive marketing and price promotions that followed, ZYN continues to dominate:

As of Q4 2022, ZYN had a 67.5% share by volume and 75.7% share by value of nicotine packaged products in the United States; Altria has 23 per cent, while BAT’s share has fallen to 4.9 per cent.

Similarly, in heated tobacco, Philip Morris continues to dominate the category, with revenues in the category almost eight times higher than BAT’s in 2022 ($9.919 billion versus £1.06 billion).

There are strong qualitative reasons why it is difficult for new entrants to win in low-risk products, such as brand recognition, consumer loyalty and scale advantages. Indeed, it has proved difficult for new entrants to challenge consumer franchises across various industries (soft drinks, coffee, beer, etc.) and we believe the reasons are structural. We expect NJOY to face the same barriers that new entrants face across the consumer space.

Heavy-handed regulatory intervention is the only scenario in which NJOY can catch up, in our view. If Vuse and Juul are somehow forced out of the market, NJOY could conceivably emerge as the winner.

However, we do not believe that an outright ban on Vuse and Juul is legally possible and is not the FDA’s intended outcome. Moreover, the FDA’s experience with its intervention on flavored e-cigarette products in late 2019 suggests that cigarettes could end up being a bigger beneficiary.

In any case, an outright ban could take months or even years to implement, by which time IQOS and BAT’s glo may already be available in the United States and offer a more desirable alternative to NJOY’s products.

NJOY is rumored to have a high valuation

According to today’s news, the valuation Altria is willing to pay for NJOY is too high.

At a headline price of $2.75 billion, even before another $500 million in earnings, Altria will pay 18 times NJOY’s 2022 sales (about $150 million), which we think is too high, especially as NJOY is likely to lose money.

Altria paid about 25 times the $12.8 billion it paid in 2018 for a 35% stake in Juul at a total valuation of $38 billion. Juul has revenue of about $1.5 billion, according to today’s report.

It also looks steep compared with Philip Morris’s purchase of Swedish Match, when its initial $17.5bn offer was equivalent to eight times Swedish Match’s 2021 sales (the subsequent higher offer only reflected a stronger dollar), even though a third of sales came from Swedish Match’s US cigar business.

Buying NJOY would be a poor allocation of capital

Our base case is that the decline in the US cigarette market will remain moderate, at least in the medium term. In this case, given Altria’s low valuation, the best use of excess capital right now is to buy back Altria shares. Altria plans a $1 billion buyback in 2023, down from $1.8 billion in 2022, although it is expected to receive another $1.7 billion (plus interest) from Philip Morris in July as part of an agreement to return U.S. IQOS rights. ($1 billion was received in October 2022.)

Even if Altria management does not see a future for its U.S. cigarette business, buying NJOY does not represent a good use of capital, as we believe NJOY is too expensive, loss-making and unlikely to catch up with competitors. Capital allocation decisions should be in the interests of shareholders, who preferably receive any residual profits from the cigarette business in the form of dividends.

To put it bluntly, buying NJOY could be an example of the faulty logic of “we have to do something, this is something, so we have to do this”.

Given that Juul is several times larger than NJOY, even buying Juul might be a better use of capital. Altria itself now values Juul’s equity at $714 million and could potentially buy the rest of Juul for less than $2 billion, even including a premium and assuming $1 billion in debt.

Unfortunately, Altria instead plans to divest its Juul stake as part of its NJOY acquisition, having relinquished its pre-emptive right in Juul last September, according to today.

The impact on other competitors

If Altria buys NJOY and assumes BAT’s Vuse and Juul stay in the U.S. market, the impact is limited for BAT but slightly negative for Philip Morris and Imperial brands.

BAT’s Vuse is currently number one at Vapor in the US, although its Vuse Go disposables have yet to reach the US market. BAT also has the scale to match any additional resources Altria might invest behind NJOY. If Altria owns NJOY, we do not believe BAT’s competitive position will be materially affected.

Philip Morris won’t regain U.S. rights to IQOS heated tobacco until after April 2024, and only plans to submit PMTA for its VEEV Vapor products in the second half of 2023. The danger for Fillo International is that rival Vapor products may take up too much of the U.S. Reduced Risk’s product space before it starts selling IQOS or VEEV there. We believe the low-risk product market is path-dependent, so the strong steam category may pre-empt the heated tobacco category.

For example, in the two largest Vapor markets in Europe, IQOS has only a 3.3% share of the UK nicotine market, while its share figures in France are not disclosed (and may be negligible).

However, ZYN is likely to continue its strong growth in the US anyway, while PM doesn’t have any cigarette sales to nibble away at in the US. So even assuming NJOY does something, it will have little impact on PM. PM could even strengthen its U.S. capabilities by acquiring Juul if Altria divested its stake.

Imperial Brands’ blu ranks fourth in the U.S. steam market and has received an FDA MDO (which the company is appealing). Stronger NJOY could hurt sales of blue and cigarettes.

Altria stock valuation

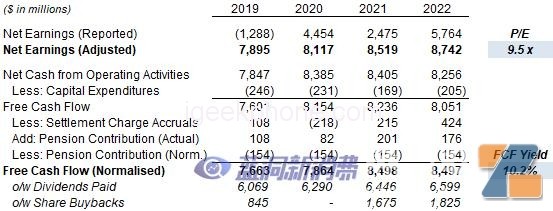

Altria shares trade at $46.54 relative to 2022, with a P/E ratio of 9.5 and a free cash flow (” FCF “) yield of 10.2%

Altria trades at 9.2 times the midpoint of its 2023 EPS guidance of $4.98 to $5.13.

The dividend yield is 8.1% and the quarterly dividend is $0.94 ($3.76 annualized), which was raised 4.4% in August 2022. Altria is aiming for a payout rate of 80%.

Altria ends 2022 with 2.1 times total debt/EBITDA and $4 billion in cash (Philip Morris will offer another $1.7 billion in July). The rumoured $2.75bn price tag for NJOY would be funded by cash on hand and would not change the total debt /EBITDA ratio. Net debt to EBITDA will rise from 1.8 times to 2.0 times.

Altria stock forecast

We leave our forecast assumptions unchanged:

Earnings per share of $5.06 in 2023, median outlook

Net revenue grew 4% from 2024

The number of shares would fall 1 percent in 2023 and then 2 percent a year starting in 2024

The payout ratio reached 80%

The P/E at year-end 2025 is 9.5 times

Our new 2025 EPS forecast remains at $5.69:

At $46.54, we expect an exit price of $54 and a total return of 46% (16.4% annualized) by end-2025.

Buying NJOY is likely to dilute earnings per share, at least initially.

These numbers reflect our base case, our view of what is most likely to happen. But there are significant tail risks. On the downside, Philip Morris is likely to gain market share in the US quickly and significantly from 2024; On the positive side, there is significant upside if the US cigarette market remains undisturbed.

Altria stock