Xiaomi is overhauling its strategy in India. The company’s costly misreading of Indian consumer tastes helped Samsung overtake Xiaomi as the No. 1 manufacturer in the world’s second-largest mobile phone market.

At a time when Indian consumers are willing to pay more for prettier and more feature-rich models, Xiaomi has remained focused on selling phones priced at less than 10,000 Indian rupees, or about $835. Samsung, by contrast, has come up with phones that meet Indian consumer expectations and offered innovative financing options to make them affordable for most people.

High-end trend

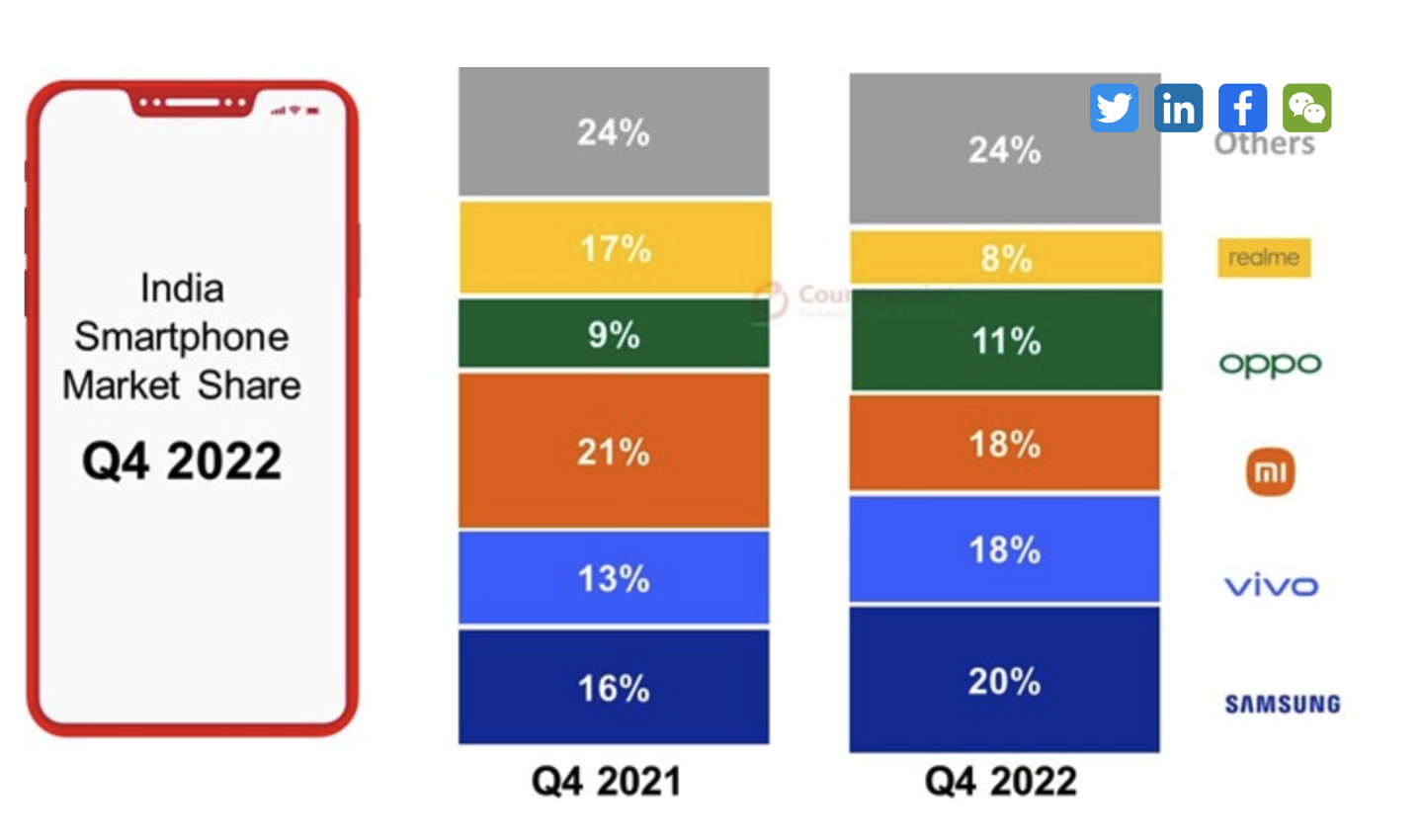

Samsung’s moves have helped it wrest the leadership position from Xiaomi in the highly competitive Indian phone market. In the fourth quarter of last year, Samsung’s share of India’s mobile phone market reached 20 per cent, surpassing Xiaomi’s 18 per cent, according to Counterpoint Research.

“The Indian market is experiencing a ‘upmarket’ trend. [But] Xiaomi was ill-prepared for this shift because of its focus on cheap phones.” “Said Tarun Pathak, research director at Counterpoint.

India has 626 million smartphone users, second only to China. Xiaomi’s loose grip on the Indian market shows that companies that fail to cater to changing consumer preferences in a fast-growing economy with rising disposable incomes will be penalised.

India’s Tata Motors, for example, once launched a car known as the Nano, which cost 100,000 rupees ($8,345) and was billed as the world’s cheapest car. But Indian consumers are reluctant to buy because they associate low prices with poor quality.

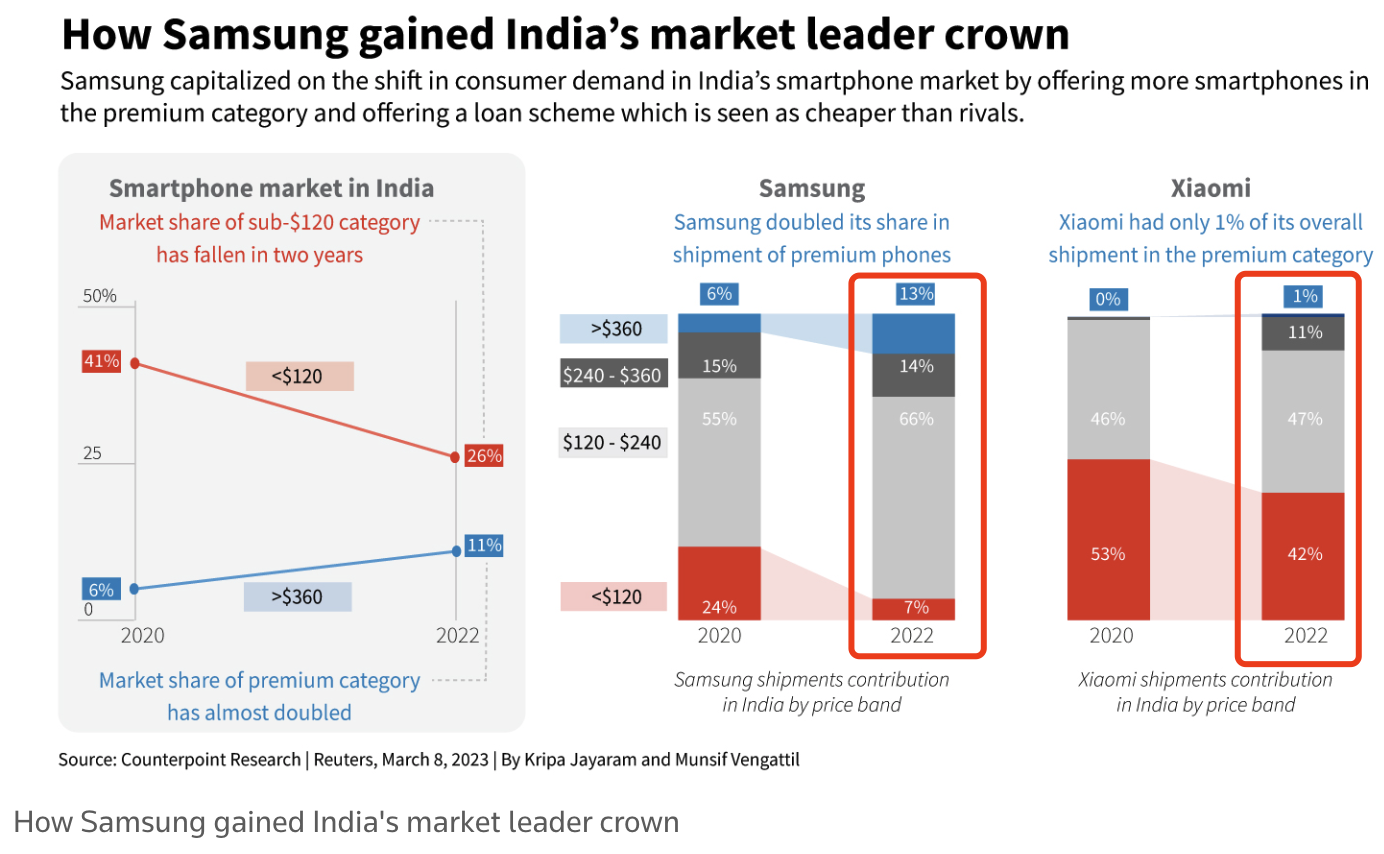

In India, the market share of phones priced under $120 has fallen to 26 percent in 2022 from 41 percent two years ago, according to Counterpoint. In contrast, high-end phones priced above 30,000 rupees doubled their market share to 11 percent over the same period.

Both Xiaomi and Samsung see India as a key growth market, and their best-selling electronic devices are smartphones. Xiaomi India’s total revenue in 2021-22 was $4.8 billion, while Samsung’s sales were $10.3 billion, of which $6.7 billion came from smartphones.

Inadequate response

However, Xiaomi is already under pressure in India after at least five senior executives left the company and the Indian government increased scrutiny of it. The move comes after $674m of Xiaomi’s funds were frozen by India’s financial crime agency over alleged illegal money transfers to foreign entities. Xiaomi denies this.

The products listed on Xiaomi’s Indian website suggest that Xiaomi’s offerings have failed to keep up with the upmarket trend of Indian consumers. Xiaomi showed six models priced above $360, while Samsung had 16. Samsung has seven models under $120, while Xiaomi lists 39 models, most of which are out of stock.

Over the past two years, high-end phones accounted for just 0 to 1 per cent of Xiaomi’s total phone shipments in India, while Samsung’s share more than doubled to 13 per cent, according to Counterpoint.

Xiaomi also admitted that it had launched “too many” models in the past. The company is revamping its product line to focus on high-end smartphones. In January, Xiaomi launched the Redmi Note 12, which costs more than 30,000 rupees ($2,505) with the top version, and the recently launched Mi 13 Pro, which costs 79,999 rupees ($6,678), is the company’s most expensive phone in India. The shift in strategy appears to have been immediate, with sales of the Redmi Note 12 reaching $61 million in its first two weeks on the market.

“We have launched a streamlined and simpler portfolio focused on building expertise at the premium end of the market, and the launch of the latest flagship Xiaomi 13 Pro is a step in that direction,” “We understand that we have a long way to go in this journey, so we will launch even stronger products,” said Muralikrishnan B, the president of Xiaomi India.

Restrict Chinese brands from selling low-end phones

Interestingly, it was reported in August last year that India was seeking to restrict Chinese mobile phone brands from selling phones priced below Rs 12,000 in order to prop up the faltering domestic mobile phone industry. This will affect a number of Chinese companies such as Xiaomi, OPPO and vivo.

The move was aimed at squeezing Chinese phone giants out of India’s low-end market, people familiar with the matter said at the time. They say there is growing concern in India that high-volume mobile phone brands such as realme and Transsion will undermine local manufacturers.

It now seems that if Xiaomi had been constrained by Indian policies at the low end of the phone market, it would have accelerated its transition to high-end phones. In the second quarter of last year, smartphones priced under $150 accounted for a third of handset sales in India, with 80 per cent coming from Chinese companies, according to Counterpoint.

Mobile phone loan

Meanwhile, a program with financing partners that provides “convenient and guaranteed” loans has played a major role in Samsung’s recent success in India, helping the company generate $1 billion in phone sales last year.

Even those with no loan history, low credit scores or no pay stubs can buy a phone, according to a Samsung phone poster found by foreign media on a dusty fruit store street in Uttar Pradesh. Sanjeev Kumar Verma, the owner of a multi-brand mobile phone shop nearby, has benefited from the company’s loan program. In an interview at his store, Mr. Verma said he used to sell five Samsung phones a month, but that has quadrupled to 20, 18 of them bought through loan programs.

Unlike its rivals, Samsung does not require proof of local address, making it easier for migrant workers or those working outside the city to take out loans to buy phones, Mr. Verma and another smartphone provider in Mumbai said. Samsung has yet to comment.

Raju Pullan, the head of Samsung’s mobile division in India, said in February that the high-end phone market was growing much faster in small towns than in big cities. Nearly half of the consumers who choose its financing plan are first-time loan seekers, he said. Samsung says its financing app, which is installed on smartphones, can lock the device and block calls from users who have not paid.

Xiaomi also uses partnerships to offer loans, which it says are a key growth driver for sales of phones priced above Rs15,000, and says it will explore more such services. Xiaomi will also open more stores outside its existing network of 20,000 retail partners and promote local sourcing of mobile components, which could help reduce costs, MuraliKrishnan said.

Some industry analysts said the new strategy could help Xiaomi return to solid growth in India. “Xiaomi has historically had strong brand value, with strong online and offline channels, and is poised to make a comeback with a strong portfolio of high-end and cost-effective products.” “Said Prabhu Ram, director of industry intelligence at CyberMedia Research.

2022 年 Q4 三星超越小米,成为印度智能手机市场第一大厂商

小米公司正在大幅调整其印度战略。此前,该公司错误判断了印度消费者的品味,这一代价高昂的失误使得三星电子在印度这个全球第二大手机市场上反超了小米,成为第一大制造商。

如今,印度消费者愿意花更多的钱购买外观更漂亮、功能更丰富的机型,但小米却依旧专注于销售售价低于 1 万印度卢比 (约合 835 元人民币) 的手机。相比之下,三星推出了满足印度消费者期待的手机,并提供了创新融资方案,让大多数人都能买得起。

高端化趋势

三星的这些举措帮助其在竞争激烈的印度手机市场从小米手中夺走了领导者地位。市场研究公司 Counterpoint Research 的数据显示,去年第四季度,三星在印度手机市场的份额达到 20%,超过了小米的 18%。

“印度市场正在经历一股‘高端化’趋势。(但是) 小米因注重廉价手机产品组合对于这种转变准备不足。”Counterpoint 研究总监塔伦・帕萨克 (Tarun Pathak) 表示。

印度拥有 6.26 亿智能手机用户,仅次于中国。小米对于印度市场的控制松动表明,在可支配收入不断增加的快速增长经济体中,未能迎合不断变化的消费者偏好的公司将受到惩罚。

例如,印度塔塔汽车曾经推出了一款家喻户晓的纳努 (Nano) 汽车,售价为 10 万卢比 (约合 8345 元),号称是世界上最便宜的汽车。但印度消费者不愿购买,因为他们会把低价与劣质联系在一起。

Counterpoint 的数据显示,印度售价 120 美元 (约合 829 元) 以下手机的市场份额已从两年前的 41% 降至 2022 年的 26%。相比之下,售价在 3 万卢比 (约合 2505 元) 以上的高端手机在同一时期的市场份额翻了一番,达到 11%。

小米和三星都将印度视为关键增长市场,他们最畅销的电子设备就是智能手机。2021 至 2022 年,小米印度总收入为 48 亿美元,而三星的销售额为 103 亿美元,其中 67 亿美元来自智能手机。

应对不足

不过,小米在印度已经面临压力,这是因为它已经有至少 5 名高管离职,而且印度政府加强了对它的审查。此前,小米有 6.74 亿美元资金被印度金融犯罪机构冻结,原因是涉嫌向外国实体非法汇款。小米对此予以否认。

从小米印度网站上列出的产品可以看出,小米提供的手机未能跟上印度消费者的高端化趋势。小米展示了 6 款售价高于 360 美元 (约合 2485 元) 的机型,而三星有 16 款。在 120 美元以下手机中,三星有 7 种机型,而小米列出了 39 种机型,其中大部分已经缺货。

Counterpoint 的数据显示,过去两年,高端手机仅占小米在印度手机总出货量的 0% 至 1%,而三星的高端手机占比增长了一倍多达到 13%。

小米也承认,过去推出了“太多”机型。该公司正在调整产品线,专注于高端智能手机。今年 1 月,小米推出了红米 Note 12,顶配版售价超过 3 万卢比 (约合 2505 元),最近推出的小米 13 Pro 售价为 79,999 卢比 (约合 6678 元),这是该公司在印度售价最高的手机。这一战略转变似乎立竿见影,红米 Note 12 上市两周内销售额就达到了 6100 万美元。

“我们已经推出了一个精简后更简单的产品组合,专注于在高端市场构建专业技能,最新旗舰小米 13 Pro 的推出就是朝着这个方向迈出的一步,”小米印度总裁穆拉里克里希南・B (Muralikrishnan B) 表示,“我们明白,我们在这段旅程中还有很长的路要走,因此我们将推出更强大的产品。”

限制中国品牌销售低端机

有趣的是,去年 8 月有报道称,印度寻求限制中国手机品牌销售售价低于 1.2 万卢比 (约合 1001 元) 的手机,以扶持发展不顺的国内手机产业。这会影响到小米、OPPO、vivo 等一票中国公司。

知情人士当时称,此举旨在将中国手机巨头挤出印度低端市场。他们表示,印度越来越担心 realme、传音等高销量手机品牌会削弱本土制造商。

现在看来,如果小米当时在低端机市场受到印度政策的限制,反而会加快其向高端手机市场的转型。Counterpoint 的数据显示,去年第二季度,售价 150 美元以下的智能手机占据印度手机销量的三分之一,80% 来自中国公司。

手机贷款

与此同时,三星与融资合作伙伴开展的一项计划提供了“方便和有保证”的贷款,在其最近在印度取得的成功中发挥了重要作用,去年帮助该公司实现了 10 亿美元的手机销售。

根据外媒在印度北方邦一条布满灰尘的水果店街道上发现的三星手机海报,三星称,即使没有贷款记录、信用评分低或没有工资单的人也可以买到手机。附近一家多品牌手机店的老板桑吉夫・库马尔・维尔马 (Sanjeev Kumar Verma) 就受益于该公司的贷款计划。维尔马在他的店里接受采访时表示,他以前每月能卖出 5 部三星手机,但现在已经翻了两番,达到 20 部,其中 18 部是通过贷款计划购买的。

维尔马和孟买的另一家智能手机供应商表示,与竞争对手不同的是,三星不要求提供当地地址证明,这让外来务工人员或在外地工作的人更容易贷款购买手机。三星尚未就此置评。

三星印度移动部门负责人拉珠・普兰 (Raju Pullan) 在 2 月份表示,小城镇高端手机市场的增长远高于大城市。他说,在选择其融资计划的消费者中,近一半是首次寻求贷款的人。三星表示,其安装在智能手机上的融资应用可以锁定设备,并阻止未还款的用户拨打电话。

小米也利用合作伙伴关系提供贷款,称这是售价 1.5 万卢比以上手机销售的关键增长动力,并表示将探索更多此类服务。穆拉里克里希南称,小米还将在现有的 2 万家零售合作伙伴网络之外开设更多门店,并促进手机零部件的本地采购,这可能有助于降低成本。

一些行业分析人士表示,新战略可能有助于小米恢复在印度的稳健增长。“小米历来拥有强大的品牌价值,拥有强大的线上和线下渠道,有望凭借强大的高端和高性价比产品组合卷土重来。”CyberMedia Research 行业情报主管普拉布・拉姆 (Prabhu Ram) 表示。