The digital age has revolutionized various aspects of our lives, bringing convenience and efficiency in numerous sectors. Banking is no exception. The concept of opening an online bank account has become increasingly popular, offering a fresh perspective on how we manage our finances. But is this digital transition right for everyone? This article weighs the advantages against the disadvantages to help you make an informed choice.

1. The Alluring Advantages of Online Banking

Convenience at Your Fingertips: One of the most significant benefits of online banking is its sheer convenience. Picture this: It’s a rainy Saturday, and instead of trekking to a physical branch, you can manage your finances from the cozy comfort of your couch. Gone are the days of standing in long queues or adhering to bank hours. With online banking, your financial management becomes a 24/7 possibility.

Streamlined Financial Management: Everything is centralized in one digital space with online banking. With integrated tools, you can easily view account balances, transfer funds, pay bills, and even budget. Think of it as having a personal financial assistant always ready to help, making managing multiple accounts a breeze.

Eco-Friendly Banking: The environment will thank you. Online banking reduces the need for paper statements, saving countless trees. Plus, you’re cutting down on carbon emissions by not driving to a bank branch. It’s a small step towards a larger goal of environmental conservation.

2. The Potential Pitfalls of Online Banking

Security Concerns: The internet is vast, and while it offers many benefits, it’s not without its dangers. Phishing scams, malware, and hackers are real threats. Is your computer’s firewall robust? Do you frequently update your passwords? Online banking requires you to be proactive about your digital security.

Lack of Personal Interaction: Sometimes, a face-to-face conversation can make all the difference. With online banking, you lose that personal touch. Remember the friendly bank teller who’d ask about your day? Online banking makes interactions transactional, potentially missing out on relationship-building moments.

Technical Glitches: Technology is fantastic, but it’s not infallible. Servers can crash, apps can have bugs, and sometimes websites undergo maintenance. Such occurrences, though usually temporary, can be inconvenient if you need immediate access to your funds.

3. Things to Consider Before Making the Leap

Your Comfort with Technology: Are you tech-savvy? While most online banking platforms are user-friendly, some might feel overwhelmed or frustrated if unfamiliar with navigating such platforms.

Accessibility Needs: If you prefer having multiple ways to access your money, including ATMs and physical branches, solely online banking might not be for you. Some online banks may not have extensive ATM networks or physical locations, potentially limiting your access.

Customer Service Preferences: Consider how you prefer to handle banking issues. If you value being able to speak to someone in person for your banking needs, online banks might pose a challenge. Most online banks offer customer service, usually via chat or phone.

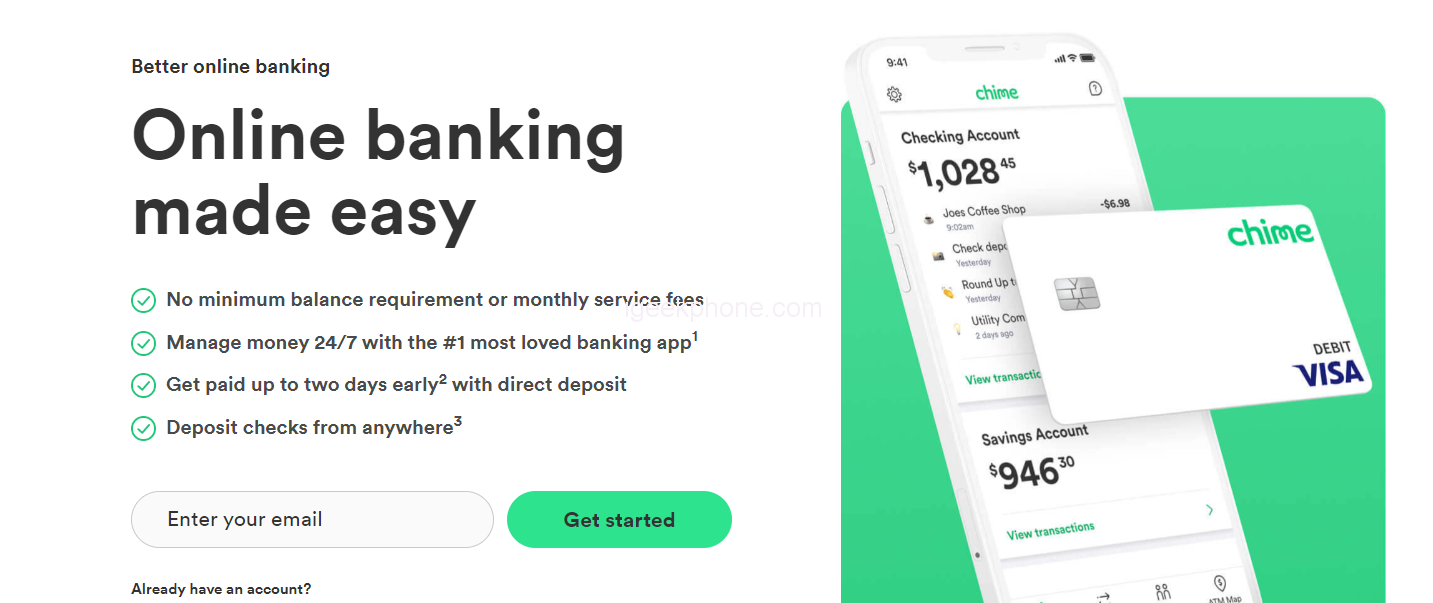

Chime experts say, “Apply in 2 minutes to start online banking through Chime. The process is straightforward as long as you have your Social Security number, email address, and a valid home address.”

Opening an online bank account is deeply personal and based on individual preferences and needs. Some might relish the convenience and eco-friendly nature of online banking, while others might value personal interactions and the tangibility of physical bank branches. It’s essential to consider both sides and decide what aligns best with your lifestyle and financial habits. After all, when it comes to banking, one size doesn’t fit all, does it?