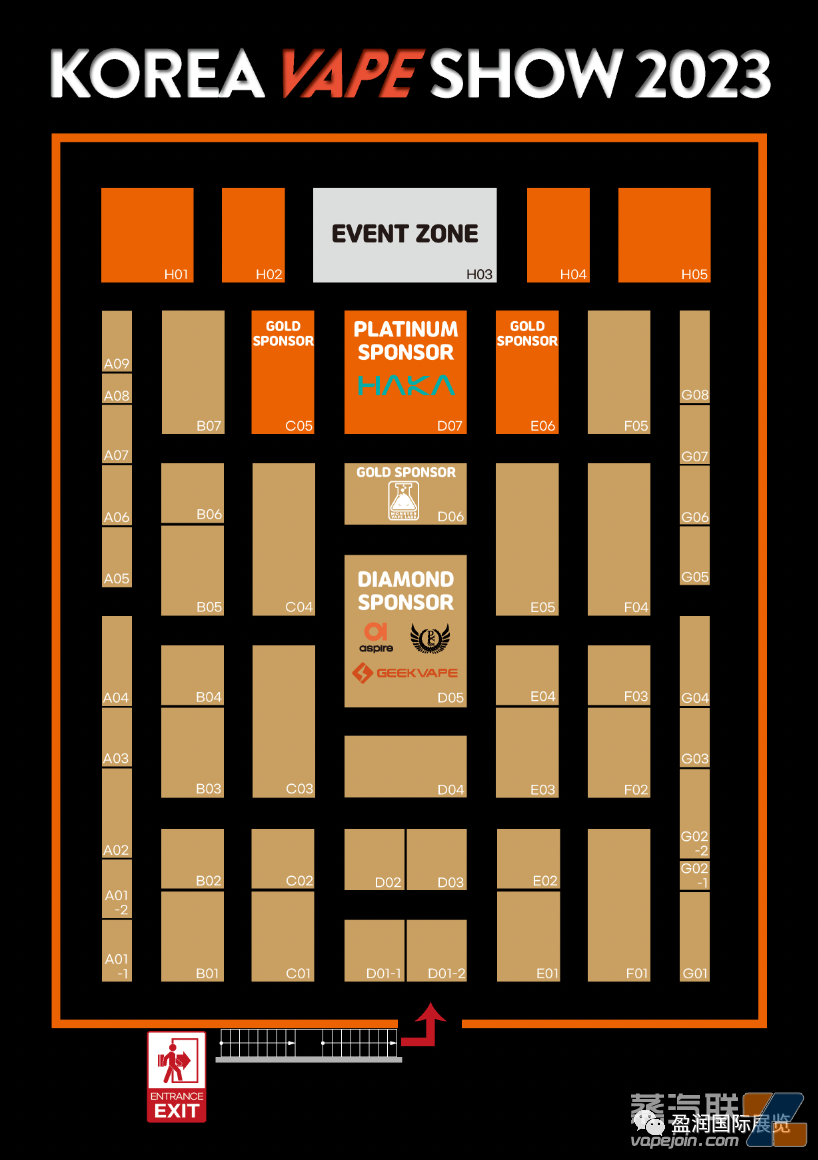

The 2023 exhibition will be the fourth Korea e-Smoke Exhibition, located in Hall 7 of KINTEX Hall 2 in Gyeonggi Province, covering an area of 14,900 square meters. The first three exhibitions were all packed, and the total number of visitors exceeded 18,200 +. Number of exhibitors 50+.

2023 · KOREA

Market outlook

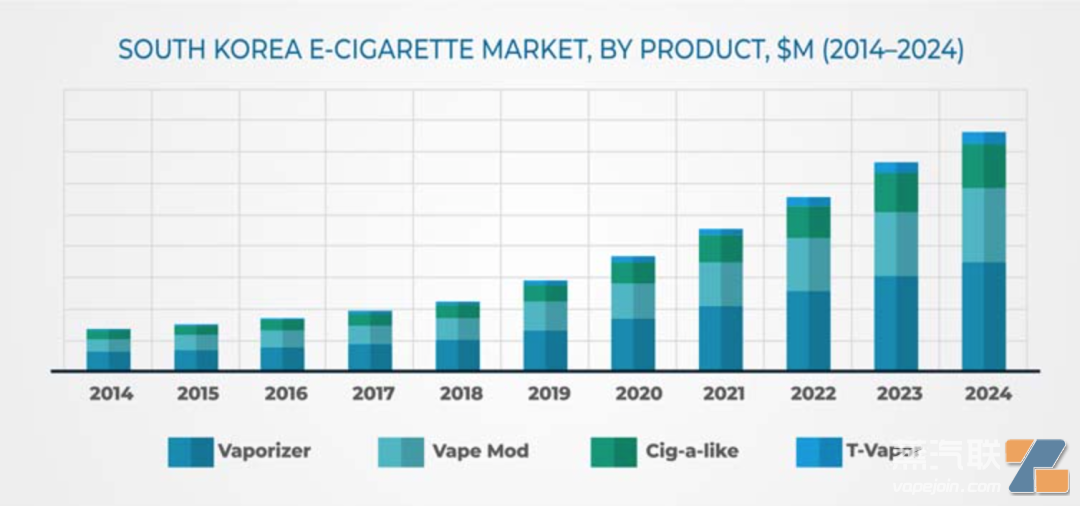

South Korea’s new tobacco market has shown a booming trend in recent years, according to data from South Korea’s statistical agency Euromonitor, South Korea’s new tobacco heating non-combustion (HNB) tobacco market in 2021 more than 2 trillion won, reaching 2.413 trillion won. It is expected to reach nearly 2.5 trillion won by 2025.

According to a survey by the South Korean Ministry of Strategy and Finance, the share of the tobacco e-cigarette market in the entire domestic tobacco market rose from 2.2% in 2017 to 14.8% in the first half of 2022. HNB products have become a new growth point in the tobacco market in South Korea in recent years. The market is expected to grow at a CAGR of 24.3% from 2019 to 2024.

The key factor driving the market expansion is the rising public preference for e-cigarettes. Technological advances in cigarettes, product design, and increased health awareness. In South Korea’s gender segment, the male e-cigarette market dominates. This is attributed to the fact that women are not allowed to consume tobacco products due to the country’s religious values and conservatism. However, the women’s category is expected to expand rapidly in the coming years as urbanization rates and education levels increase and companies launch targeted marketing campaigns.

Many people are turning to e-cigarettes or vape mods as an alternative to smoking. In addition, these products are available in non-nicotine and nicotine forms, so many people consider these devices to be a better alternative. The increasing number of young people using these products has led to increased demand. South Korea is one of the fastest growing markets for e-cigarettes worldwide, attracting the attention of major international manufacturers such as JUUL Labs.

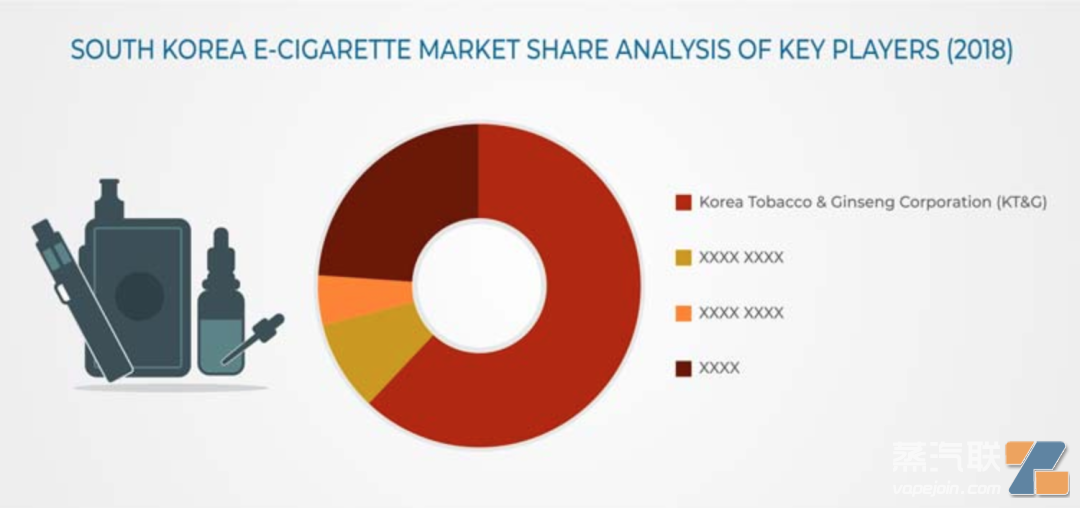

PMI (Philip Morris International), KT&G (Korea Tobacco) and BAT (British American Tobacco) are the main players in the HNB market in South Korea. KT&G occupies a dominant position in South Korea with its huge distribution network. However, in recent years, as the stock of the domestic market has bottomed out, KT&G chooses to cooperate with PMI to explore the international market, and the two sides move from domestic competition to international cooperation. BAT is adopting a low-cost product strategy to grab new users in the market.

KT&G is the largest tobacco company in South Korea, with an operating margin of 30 percent in 2022 and the largest market share in South Korea at 48 percent.

KT&G’s CEO, Fu-in Bai, said at the 2023 investor conference:

“By 2027, we will increase the sales share of the global market to 50% and the sales share of NGP and health functional foods to 60%.”

KT&G chose to partner with PMI, the world’s number one tobacco company.

The two companies have signed a three-year contract for PMI to sell KT&G’s HNB products in the global market starting in 2020.

In February of this year, the two sides renewed a 15-year long-term contract.

According to the disclosure, KT&G’s HNB products will be sold in 70 countries or regions around the world where PMI operates.

PMI comments on why it accepted KT&G’s products into its distribution network:

“PMI is confident that even if KT&G grows in the global market, it will not reach levels that threaten it.”

PMI’s confidence comes from the strong sales of its products around the world, and its total number of IQOS users is estimated to be about 25 million, according to PMI’s 2022 annual report.

In addition, the government is expected to continue to crack down on cigarette sales in the country in the coming years, thus driving the popularity of e-cigarettes. In addition, consumers in the country are concerned about the quality of local and Chinese-made e-cigarettes. This perception is creating lucrative growth opportunities for global tobacco companies with mature e-cigarette product portfolios.

In 2022, PMI Korea’s sales of IQOS products increased 21.5 percent to 686.7 billion won, while operating profit increased 16.27 percent to 80.6 billion won in the same period.

Outside analysts believe that PMI Korea’s sales rebound in 2022 has given PMI a shot in the arm, and PMI will develop new strategic measures through the replacement of senior executives to achieve share growth.

2023·KOREA

diversification

Rapid advances in such e-cigarette device technology are driving the expansion of the e-cigarette industry in South Korea. Tobacco producers are increasingly focusing on developing new technologies and launching innovative products to break into emerging markets and gain an edge over competitors.

Competitive pattern

E-cigarette market players are increasingly focusing on strategic partnerships, mergers and alliances to gain a foothold in the market. For example, Altria Group bought a 35% stake in e-cigarette maker JUUL Labs inc. for $12.8 billion. Its investment in JUUL Labs nc is the largest in the company’s history. The acquisition will allow the company to expand its presence in the e-cigarette market.

Some of the major players in the South Korean e-cigarette market include British American Tobacco, Altria Group, Japan Tobacco, Imperial Brands, Philip Morris International, JUUL Labs lnc, Shenzhen iSmoka Electronics Co., LTD. Shenzhen IVPS Technology Co., LTD., Innokin Technology Co., LTD., Shenzhen Kanger Technology Co., LTD., Korea Tobacco Ginseng Company.