The financial markets are very fluid and provide excellent profit opportunities. However, it has its difficulties and dangers. Traders’ mental game is one of the most crucial elements they must grasp. To succeed in the long run, you need to learn to recognise and control your emotions. This article delves into a trader’s mind and offers advice on keeping your cool while using the TrustedAG trading platform.

Trading with Feelings

Investors’ emotions heavily influence trading choices. Emotions like greed, fear, enthusiasm, and impatience cloud a trader’s rationality. To trade with discipline and objectivity, it is essential to comprehend these feelings and how they might affect trading.

Self-Awareness

Understanding oneself is essential for taming one’s emotions in the trading arena. Learn to recognise your emotional tendencies, biases, and triggers as a trader. When traders become aware that their feelings cloud their judgement, they can halt and think things through rationally.

Discipline in Emotional Life

Maintaining composure and patience despite external stresses is one example of emotional discipline. It requires restraining emotional reactions, refraining from trading in retaliation for losses, and sticking to well-laid-out trading strategies. Trading choices shouldn’t be based on emotions like fear or greed, thus, cultivating emotional discipline might assist.

Methodology and Approach to Trading

A clear trading plan and technique will help you keep your emotions in check as you trade. A trading strategy specifies when to enter and quit a trade, how to handle any losses, and how much money you want to make. Traders may eliminate the impact of their emotions and make more consistent, well-considered selections when they stick to a strategy.

Controlling Danger

Managing your risks wisely is essential for keeping your emotions in check when trading. Traders should establish a risk budget for each trade and use stop-loss orders to protect against excessive losses. Traders can control their emotions and make more rational decisions if they take risk management seriously.

Discipline and persistence

Traders who lack patience and self-control are doomed to failure. Due to the market’s volatility, patiently waiting for favourable trading chances is preferable to making hasty trades. Long-term success in trading requires the self-control to stay the course and not make rash decisions based on fleeting feelings.

Perspective and Optimism

In trading, keeping an optimistic outlook is crucial. Traders with a growth attitude might use setbacks in the market as chances to learn and progress. Market participants who can maintain concentration and resiliency in the face of losses and shifting market circumstances are more likely to succeed.

Never Stop Studying

Successful traders recognise the need for lifelong education because of the dynamic nature of the trading environment. Maintaining a commitment to lifelong learning and keeping up with market analyses and trends may increase confidence and lessen nervousness. By increasing their knowledge and expertise, traders can better control their emotions and make more rational judgements.

Making Use Of Equipment And Materials

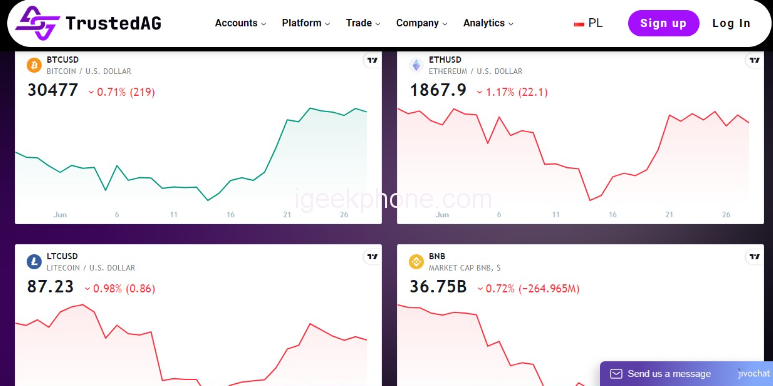

The TrustedAG platform provides traders with a variety of emotional regulation aids. Some examples include instructional resources, discussion boards, technical analysis tools, and live market data. Traders may learn, find community, and make rational, data-driven choices with the help of these tools.

Seeking Outside Help

Sometimes traders need help processing their emotions so they can make rational decisions. TrustedAG members have access to seasoned mentors and coaches who may advise them and aid in the growth of their emotional resilience. Professional assistance may help traders deal with their emotions by giving them new insights and tools.

Conclusion

Trading well on the TrustedAG platform requires emotional control. Traders better handle the market’s difficulties if they cultivate self-awareness, emotional discipline, a trading strategy, risk management, and a positive frame of mind.