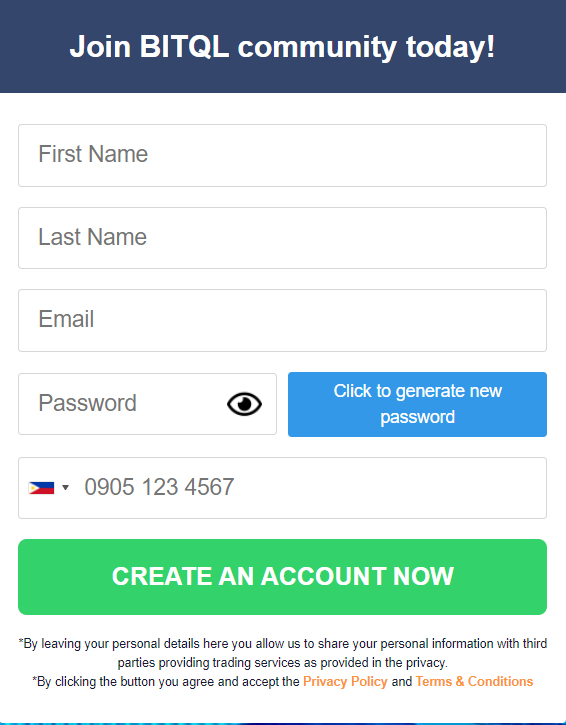

It would have been all right if the crypto crash had not affected other assets, such as non-fungible tokens (NFTs), etc. However, the impact on a major digital asset, whatever be the reason, has created apprehensions in the minds of investors, about what the future scenario would be like for the other assets. Click this image below to start your crypto journey.

Celebrities and NFTs

Such news is shocking, because a group of celebrities, including Serena Williams, Paris Hilton, Gwyneth Paltrow, etc., had been publicly endorsing the ownership of NFTs. Their speeches resulted in the inflation of a multi-billion-dollar bubble involving NFTs. Even then, the continuous fall of the crypto market has made investors wary! It has not helped that there have been frauds involving NFTs, either.

One such fraud was to create duplicates or fakes of self-owned NFTs on cryptocurrency exchanges, such as LooksRare, OpenSea, etc., and sell them. This gave the impression that a profitable enterprise was on the way. Creating copies was not difficult, for adequate tools were available, especially those linked to cryptocurrency exchanges. After all, NFTs consist of virtual images, avatars dealing with objects, games, property, etc. in the Metaverse, collectible items, etc. In simple language, only two NFTs may be of a kind and mutually interchangeable. Otherwise, NFTs, in general, are unique, for each owner desires to be different from other owners. Nonetheless, creating copies of non-fungible tokens was not easy, since they tended to be one of a kind. Nonetheless, cybercriminals managed it!

It is not only the visual art world that gained. Another use case for an NFT project, was music. To illustrate, 4,700 recordings by popular singer/musician, Jonathan Mann, reached fans in the form of NFT videos. Similarly, the Kings of Leon band sold out every VIP seat for future concerts, via NFTs.

NFTs Do Not Seem to Have Resale Value

As mentioned earlier, wariness about cryptos, has carried over to the NFTs, too. According to surveys, the trading of NFTs went down by at least 50% in the first half of the year. Experts lamented that a mere $31 million had gone towards expenditure on collectibles and art. Resale figures of NFTs were also low. Jack Dorsey, the founder of Twitter, highlighted this via a tweet. He had managed to sell an NFT for $3 million. However, the new owner was finding it terrible work, to dispose of it again, for anything below $20,000.

A well-known critic, Molly White offered two reasons for the pathetic state of NFTs. One of them could be overhyping in the beginning, and a sudden decrease in it. Another could be the very real fear of being cheated via intelligent fraudsters. To illustrate, Axie Infinity had the experience of losing over $500 million, thanks to fraudsters.

Apart from this, reproduced NFTs (via Open Sea’s free tool) were duplicates of reputed artworks or other NFTs. Admittedly, no permission had been asked to reproduce them. Furthermore, the NFT site was under no regulatory orders or supervision. The same scenario has taken place on an NFT exchange, LooksRare, which always looks for guidance towards OpenSea. Over 95% of the transactions taking place on its platform, were fake. Many involved investors selling NFTs to themselves. This way, they hoped that they would not be found dealing in fake transactions. Yet, they were found out!

There is Hope

However, there is no need to despair. Things are beginning to show improvement. For instance, several Ethereum projects involving NFTs, include Bored Ape Yacht Club, Moonbirds, Mutant Ape Yacht Club, etc. They are trying very hard to regain their losses. Until now, they have succeeded in regaining a foothold by 10%-20%. Such an outcome reveals hope for the near future.

Another suggestion given by several experts is the formulating of regulations, which may be enforced if things go wrong. The existing policies do not suffice to tackle long-lasting or serious crimes. At the same time, the laws should not be such that they come in the way of NFT owners garnering profits.

Critics also recommend the lowering of hype, and giving false impressions to investors. Market places tended to be volatile. Furthermore, the performances of digital assets seemed to be linked to one another. There was no guarantee of what could happen next.